| |

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ qi

���D�D�����Ϥ��p�U�GUS ���D�D�����Ϥ��p�U�GUS

p p

bw\ bw\

�����d�ݹϤ��ԲӸ�� �����d�ݹϤ��ԲӸ�����bŪ�����Ϥ����ԲӸ�ơA�еy�� ... |

to

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ 5

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ P6O

J.K. Rowling EFyOS-

Age: 43 ,?

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ V

Net Worth: $1 billion~H13

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ sj>I

Industry: Media/Entertainment IG+=|g

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ Z)N-C

Sometimes sheer talent and persistence is enough. As a single mother on welfare in Scotland, Rowling began writing the first Harry Potter novel in Edinburgh cafés whenever she could get her infant daughter to sleep. After being rejected by 12 publishing houses, Bloomsbury, a small publisher in London, offered an advance of 1,500 pounds (about $2,400)--even while one its editors, Barry Cunningham, advised Rowling to get a day job. Good thing she didn't listen: The following year, U.S. publishing rights to the first Potter book sold for $105,000. Rowling has since sold nearly 400 million copies worldwide, and is the only author on the Forbes list of the richest people in the world.

/fJim

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ \KR

Reporting current as of June 2009. O-}[

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ y&5

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ }J`&b

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ #{|Cc9

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ cR}

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ yF=y7

���D�D�����Ϥ��p�U�G&LUX ���D�D�����Ϥ��p�U�G&LUX

]MU ]MU

.Z6 .Z6

�����d�ݹϤ��ԲӸ�� �����d�ݹϤ��ԲӸ�����bŪ�����Ϥ����ԲӸ�ơA�еy�� ... |

l5u

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ g/M=Z;

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ d!H

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ vkDZt

Oprah Winfrey _S

Age: 55 m^^c

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ TeL

Net Worth: $2.7 billion xy`At1

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ H82s#

Industry: Media/Entertainment 2/

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ 7xCx

The accidental daughter of two Mississippi teenagers, Winfrey faced poverty and physical abuse from an early age. A stellar student, she won oratory and beauty contests and eventually earned a scholarship to Tennessee State University, later becoming the first black female news anchor at Nashville's WLAC-TV. At 29, she hosted a Chicago morning television show called AM Chicago, later re-named The Oprah Winfrey Show. A millionaire by age 32, Winfrey branched out on her own in 1998 by founding Harpo Studios, producer of films and television shows including the Dr. Phil show and the Rachael Ray show. Other Oprah ventures include the cable television network Oxygen (purchased in 2007 by NBC for $925 million) and publications O, The Oprah Magazine and O at Home.

|

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ '

Reporting current as of June 2009. GqpiB%

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ m37F/=

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ DX[v

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ B)

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ 4mZ

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ >

���D�D�����Ϥ��p�U�GqP6N4 ���D�D�����Ϥ��p�U�GqP6N4

K K

a< a<

�����d�ݹϤ��ԲӸ�� �����d�ݹϤ��ԲӸ�����bŪ�����Ϥ����ԲӸ�ơA�еy�� ... |

ro}

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ _;eQM

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ &ywr

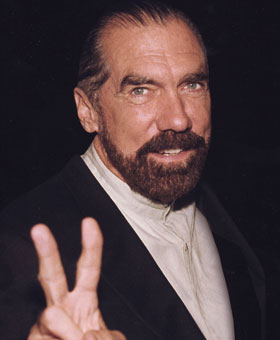

John Paul DeJoriap

Age: 65 Ij

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ MJ*MM.

Net Worth: $2.5 billion +J>^P

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ |n(9

Industry: Hair Products, Tequila q"{^W

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ s

DeJoria started out as a door-to-door Christmas card salesman in Los Angeles at age nine. After a short stint in the Navy, he returned to his salesman roots, selling encyclopedias. In 1980, with just $700 and an iron will, DeJoria and friend Paul Mitchell, a hairdresser, decided to launch a new line of shampoo and other hair care products based on a new formula Mitchell had developed. In the early months, when he wasn't pounding on salon doors and told to bug off, DeJorira bought supplies on credit and lived in his car. Without ever borrowing a dime, Paul Mitchell Systems became the largest salon-only hair care company in the U.S., with products in 10% of salons across the country. Then came his (and partner Martin Crowley's) agave assault with Patron. DeJoria currently owns a 51% stake in Paul Mitchell Systems and 70% of Patron.

C*

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ K

Reporting current as of June 2009. \mL

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ v/e5?

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ J

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ I

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ J&_#a#

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ [9TMnH

���D�D�����Ϥ��p�U�Gh ���D�D�����Ϥ��p�U�Gh

LUDNJg LUDNJg

?R$o ?R$o

�����d�ݹϤ��ԲӸ�� �����d�ݹϤ��ԲӸ�����bŪ�����Ϥ����ԲӸ�ơA�еy�� ... |

9ZNk

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ wC.

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ ^Lmh8

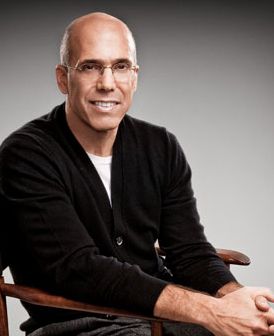

Jeffrey Katzenberg 6q0hq

Age: 58 @NeC

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ cb0g

Net Worth: $750 million $6

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ `os

Industry: Media/Entertainment (IP

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ D

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ t

While he didn't launch a business on a shoestring, Katzenberg spent decades building a network that would eventually help him launch one of the most storied movie studios of all time. He began honing his skills at age 15 as a volunteer in John Lindsay's campaign for mayor of New York in 1965. Through a connection at Lindsay' office, he later met Barry Diller, then president of Paramount, who invited him to Los Angeles to work as his assistant. During his 11 years at Paramount, Katzenberg also befriended Michael Eisner, then chief executive of the movie studio. When Eisner left Paramount for Disney in 1984, he took Katzenberg with him; there they pumped out hits like The Little Mermaid, Beauty and the Beast and Aladdin. After a falling out with Eisner in 1994, Katzenberg left to launch his own studio, DreamWorks SKG, with the likes of Steven Spielberg and David Geffen. mJ

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ b1t<

Reporting current as of June 2009.

BtO?.n

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ q|

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ bLA

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ e

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ SHESp

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ CM)&T

���D�D�����Ϥ��p�U�G(l?jXL ���D�D�����Ϥ��p�U�G(l?jXL

hXK hXK

7J 7J

�����d�ݹϤ��ԲӸ�� �����d�ݹϤ��ԲӸ�����bŪ�����Ϥ����ԲӸ�ơA�еy�� ... |

!EYA]

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ N9Th?

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ 20~~<H

William Moncrief Jr.;E,&

Age: 89 ~QFJ\P

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ `#h

Net Worth: $1.1 billion H

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ "`/

Industry: Oil l

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ q

At 10 years old I watched my Daddy drill into the East Texas oil fields, and I turned to my mother and said, "When I grow up I want to be an oil man," says Moncrief Jr., who went on to study petroleum engineering at the University of Texas and work briefly with another oil company in Indiana. While his father was successful, Junior didn't take any handouts. "Any deals we did together we would own 50-50 in each of our names," he says. When Dad passed away in 1986, he left everything he owned--including his shares of the business--to his other children and grandchildren, knowing that Moncrief Jr. had enough money and land of his own.

jN

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ LA;"#

Reporting current as of June 2009. o,^,

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ 4u

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ 5mDP^-

©�t�ͳN�Ƭ�s�� -- �N�Ƭ�s�@�@ ({EW

| | |

|

|

|

�D�D�z�G

�`�T��

�D�D�z�G

�`�T��  �����`�T��

�����`�T��  �ϩT��

�ϩT��  �����ϩT��

�����ϩT��  �T��

�T��  �����T��

�����T��  ����

����  �I��

�I��

�����[��

�����[��  ���

���  �������

�������  ��w

��w  ����

����  �R��

�R��  �R���^��

�R���^��  ����

����